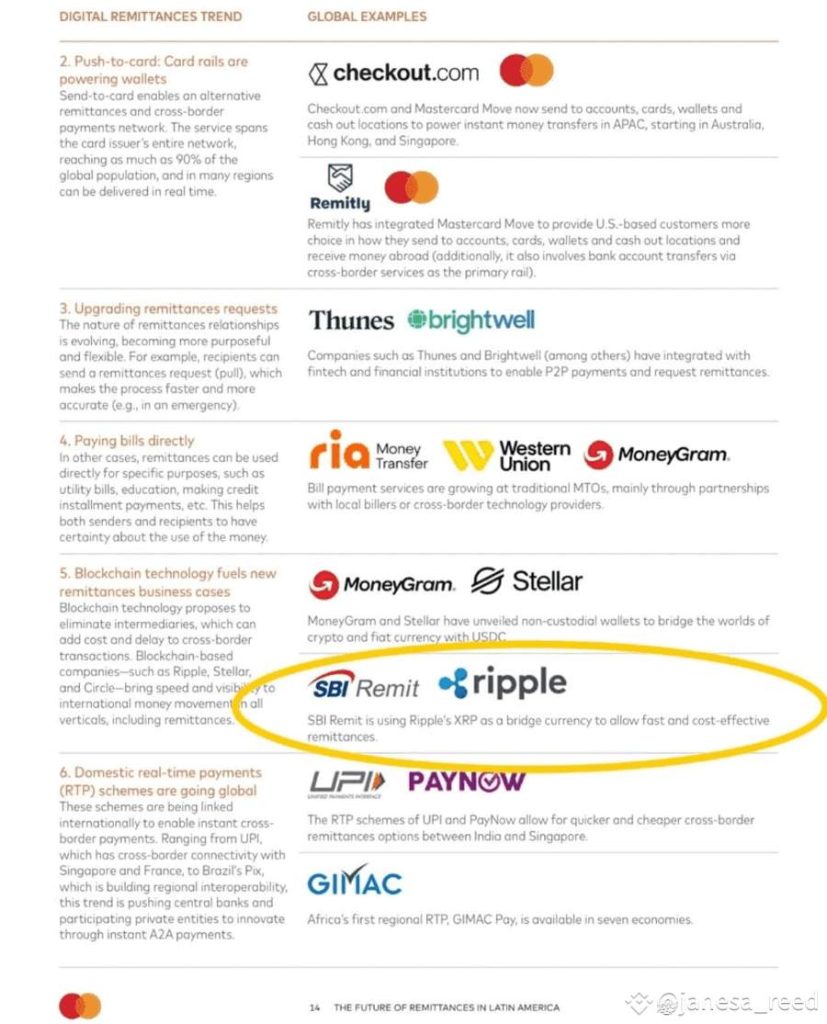

In a significant development for the cryptocurrency landscape, Mastercard has recognized Ripple’s XRP as a bridge currency in its recent report, “Blockchain Technology Fuels New Remittances Business Cases.” The report highlights XRP’s role in facilitating efficient cross-border payments, with a particular focus on its adoption by Japanese money transfer service SBI Remit.

SBI Remit’s utilization of XRP underscores a growing trend among financial institutions to leverage digital assets for faster and more cost-effective international transactions. By employing XRP as a bridge currency, SBI Remit aims to reduce the need for pre-funded accounts in multiple currencies, thereby enhancing liquidity and reducing operational costs.

This endorsement by Mastercard has reignited discussions about a potential integration between Ripple’s XRP and SWIFT, the global messaging network for cross-border payments. Previous reports have indicated that banks have tested XRP’s compatibility with SWIFT, suggesting a possible collaboration that could significantly boost XRP’s adoption among global financial institutions.

Ripple’s strategy of positioning XRP as a bridge asset aims to streamline the process of converting one fiat currency to another, eliminating the need for multiple pre-funded accounts and enhancing liquidity in regions underserved by traditional banking systems. The company’s participation in a Bank for International Settlements (BIS) task force further emphasizes its commitment to improving cross-border payment systems.

As XRP continues to gain traction in the financial sector, its current price stands at $2.40, reflecting a modest increase of 1.27% from the previous close. The cryptocurrency’s growing adoption by major financial entities like Mastercard and SBI Remit signals a promising trajectory for its role in the future of global payments.

Discussion about this post