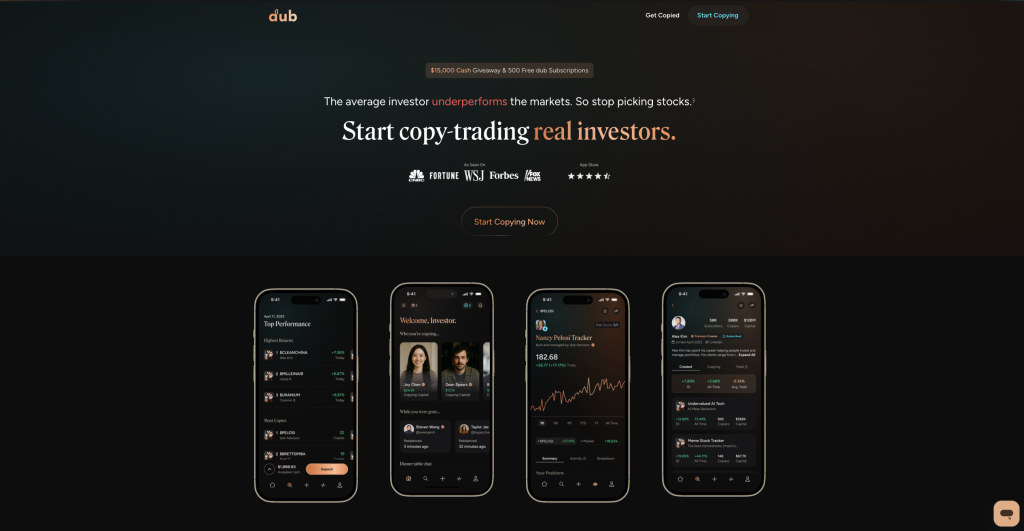

Dub, the innovative copy-trading platform, has secured $30 million in Series A funding to further its mission of democratizing investment strategies. This latest round brings the company’s total funding to $47 million.

Empowering Everyday Investors

Founded in 2024 by Steven Wang, Dub offers users the ability to mirror the investment portfolios of successful traders and financial influencers. For a $9.99 monthly subscription, users can automatically replicate trades from their chosen creators, making sophisticated investment strategies accessible to a broader audience.

Building a Financial Creator Economy

Dub’s platform not only allows users to follow seasoned investors but also enables individuals to become creators themselves. Qualified creators can earn royalty fees based on the number of followers and the performance of their portfolios. This model fosters a community-driven approach to investing, where insights and strategies are shared and monetized.

Integrated Brokerage Services

Setting itself apart from other platforms, Dub operates its own SEC-registered brokerage. This integration allows users to deposit funds directly into the app without needing to link external accounts, streamlining the investment process and enhancing user experience.

Strategic Investment and Growth

The Series A funding round was co-led by Notable Capital and Neo, with participation from Sandberg Bernthal Venture Partners, Peak6 Strategic Capital, and Correlation Ventures. Additionally, Silicon Valley Bank provided a $5.5 million venture debt facility. The capital will be used to scale operations, enhance platform features, and expand the user base.

A New Era of Social Investing

Dub’s rapid growth, including surpassing 1 million downloads, indicates a strong market appetite for social investing tools. By combining the influence of financial creators with accessible technology, Dub is reshaping how the next generation approaches investing.

Discussion about this post